nj property tax relief check 2021

CuraDebt is a debt relief company from Hollywood Florida. New Jersey has mailed out more than 600000 income tax rebates as of last week sending money to everyone who filed their taxes by early.

Freehold Township Sample Tax Bill And Explanation

This is what I know about your 500 tax rebate check.

. Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. Previously the states property tax deduction for veterans applied only to those who served in wartime. News 12 Staff New Jersey property owners could see a 500 property tax rebate under an agreement that state officials announced on Monday.

If the 2021 property taxes for the entire property to- taled 4000 and the 2020 property taxes totaled 3800 and you indicated at line 12b that you occupied 25 of the property one unit you must enter 1000 4000 25 on line 13 and 950 3800 25 on line 14. COVID-19 Teleworking Guidance Updated 08032021. To qualify you must.

The older people are the ones living on fixed incomes and paying the highest property taxes in the country. It was established in 2000 and has since become an active member of the American Fair Credit Council the US Chamber of Commerce and is accredited with the International Association of Professional Debt Arbitrators. Now the average Homestead Benefit is about 490 and it is calculated based on the 2006 tax year according to the state tax data.

Ad Mortgage Relief Program is Giving 3708 Back to Homeowners. Governor Murphy estimates that eligible residents will see their payments increase by about 130 to 145. Check Your Eligibility Today.

About the Company Nys 2021 Property Tax Relief Check Waterloo Ny. NJ Income Tax Property Tax DeductionCredit Eligibility Requirements All property tax relief program information provided here is based on current law and is subject to change. Allow time for delivery.

For those who qualify the checks are supposed to effectively freeze property-tax bills that now average an all-time high of 9112 in New Jersey. Just how much property tax relief would people see. We began mailing checks July 2 and anticipate it will take about six weeks for all of the initial checks to be processed.

Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. Be a New Jersey resident for all or part of 2020. NJ Income Tax Property Tax DeductionCredit Eligibility Requirements.

We will continue to issue rebates to eligible recipients as 2020 tax returns are processed. Jun 22 2021 112am Updated on Jun 22 2021 By. Submit a 2020 NJ-1040.

New Jersey veterans who served in times of peace will receive expanded property tax relief. However New Jerseys most expensive property-tax relief program according to budget documents allows homeowners regardless of their annual income to deduct up to 15000 in local property taxes annually.

Township Of Nutley New Jersey Property Tax Calculator

Nj Div Of Taxation Nj Taxation Twitter

Checking Gov Murphy S Claims On Tax Cuts Nj Spotlight News

Re My Nj Tax Return Not Picking Property Tax Dedu Page 2

Deducting Property Taxes H R Block

New Jersey Tax Forms 2021 Printable State Nj 1040 Form And Nj 1040 Instructions

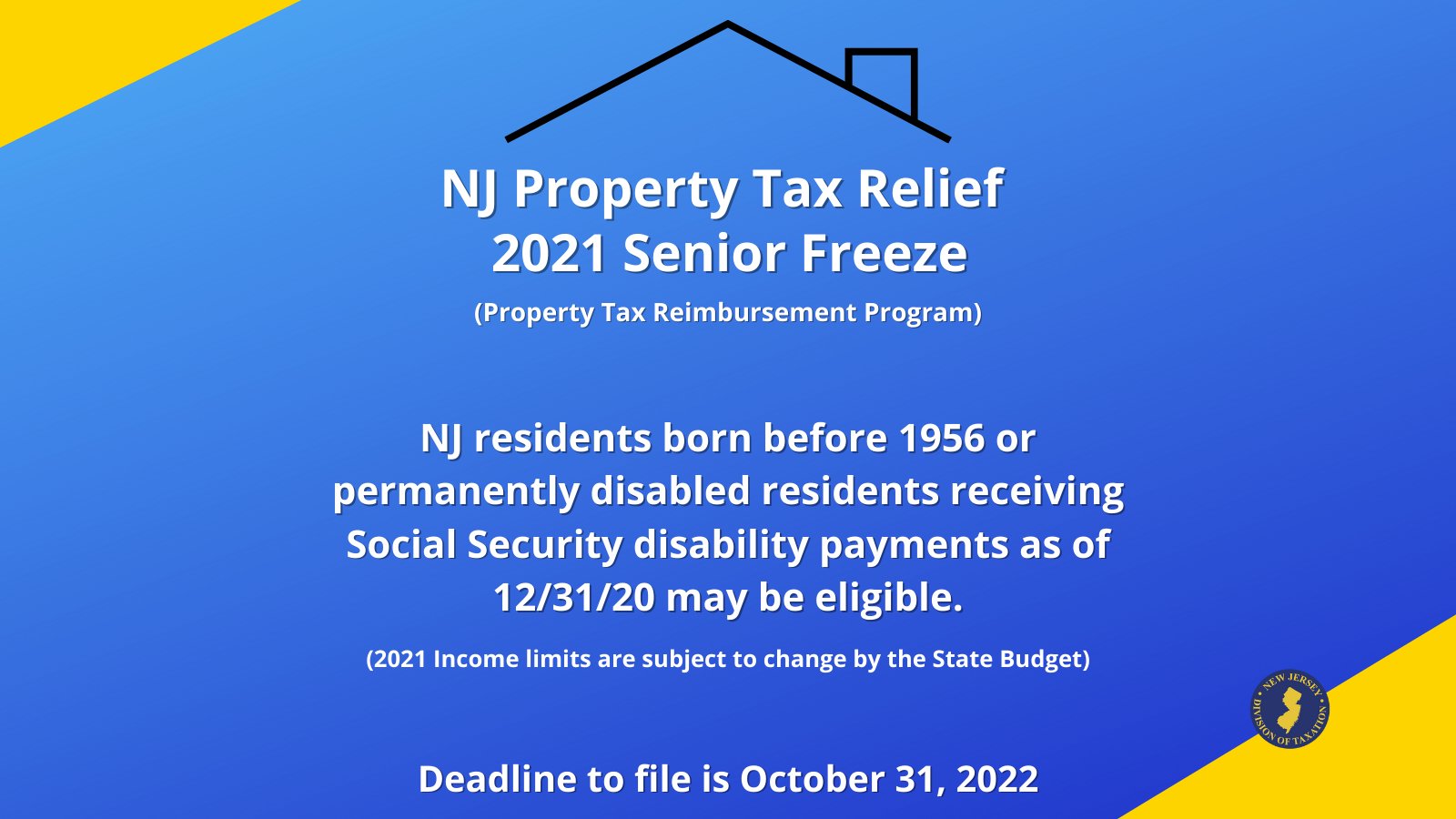

Nj Property Tax Relief Program Updates Access Wealth

Senior Freeze Homestead Benefit Programs River Vale Nj

Solved How Do I Report Hsa Interest Dividends And Capit

Tax Collector S Office City Of Englewood Nj

Re My Nj Tax Return Not Picking Property Tax Dedu Page 2

The Official Website Of The Township Of Belleville Nj Tax Collector

Freehold Township Sample Tax Bill And Explanation

Nj Property Tax Relief Program Updates Access Wealth

My Nj Tax Return Not Picking Property Tax Deductio

Township Of Nutley New Jersey Property Tax Calculator

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global